ING Direct Depot Review

ING Direct Depot

- Free custody & wide product range

- €0 ETF savings plans

- BaFin-regulated German bank

- Savings plans from €1

| Minimum Deposit: | None |

| Trading Fee: | €4.90 + 0.25% |

| Available Assets: | Stocks, ETFs, Funds, Bonds, Certificates |

| Platform: | Mobile & Web |

ING Direct Depot is a well-established German brokerage account designed for simple, low-cost investing. The platform offers free custody, broad access to German and international markets, and a strong focus on user-friendly tools for beginners and long-term investors.

Clients can trade stocks, ETFs, funds, bonds, certificates and leveraged products across major exchanges or use automated savings plans starting from just €1. Backed by more than a decade of industry awards and consistently high ratings for pricing and service, ING positions its Direct Depot as a practical choice for everyday investors who want transparent fees and a clean, reliable interface.

Key Strengths

- Free custody with no ongoing depot management fees

- Wide product range including stocks, ETFs, funds, bonds, certificates and leveraged products

- Competitive pricing at €4.90 + 0.25 percent per trade with a capped maximum of €69.90

- Strong reputation with repeated awards as “Best Online Broker”

- Extensive savings plan options starting from €1, including permanently discounted ETF plans

Weaknesses

- Percentage-based trading fee becomes costly for large order sizes

- Limited access to non-European markets beyond USA and Canada

- Advanced products like leveraged certificates require additional suitability approval

- No multi-currency accounts for holding foreign currencies

- No access for non-residents; accounts are only available to individuals with German residency

Trading Costs

ING Direct Depot uses a transparent, hybrid pricing model that combines a fixed fee with a small percentage of the order value. This makes smaller and medium-sized trades inexpensive, while larger trades become less cost-efficient due to the percentage component. Savings plans are one of ING’s strongest pricing advantages, with ETF savings plans executed at €0 and attractive reductions on funds and certificates.

Typical order pricing is €4.90 + 0.25 percent of the trade value, capped at €69.90. Direct trading carries no venue fee, while German and international exchanges apply additional fixed charges depending on the venue.

Below is an example fee table (same layout as used in your “Trade Republic Fees Overview”, adapted to ING):

| Fee Type | ING Direct Depot Fees |

|---|---|

| Custody (Depotführung) | Free |

| Standard Trade | €4.90 + 0.25 percent, max €69.90 |

| Direct Trading Venue Fee | €0 |

| German Exchange Fee (Xetra, Frankfurt etc.) | €2.90 |

| Munich, Stuttgart, Euwax, Frankfurt Zertifikate | €1.90 |

| USA & Canada Trading | €14.90 |

| ETF Savings Plans | €0 |

| Stock & Certificate Savings Plans | 1.5 percent of order value |

| Dividend Reinvestment (Stocks) | 1.5 percent, max €9.90 |

| Dividend/Ausschüttung Reinvestment (ETFs/Funds) | Free above €75 |

ING’s structure is designed to reward long-term portfolio building through low-cost savings plans while still offering straightforward pricing for active traders.

Available Assets

ING Direct Depot provides broad access to all major asset classes listed on German exchanges, combined with selective access to North American markets. The product universe is designed to support both passive investors building long-term portfolios and active traders who want intraday market access.

Stocks

Clients can trade all stocks listed on German exchanges, including blue-chip and mid-cap segments, as well as major US and Canadian equities. Trading is available via direct trading partners and traditional exchanges such as Xetra and Frankfurt.

ETFs

The ETF offering is one of ING’s strongest features. Investors can choose from a large selection of German-listed ETFs covering global equities, thematic strategies, bonds, commodities and smart-beta indices. ETF savings plans execute from €1 with €0 service fee, making ING highly attractive for long-term investing.

Mutual Funds

ING provides access to a broad lineup of active and passive funds. Many fund purchases come with up to 100 percent discount on the initial sales charge when bought via direct trading, making them competitive versus traditional banks.

Bonds

Government and corporate bonds listed on German exchanges are available. This includes short-, medium- and long-duration instruments with varying risk profiles. Bond trading follows the standard order and venue fee structure.

Certificates & Structured Products

ING offers access to a wide range of certificates and structured products, including discount certificates, bonus certificates and other leveraged instruments. Trading these instruments requires a prior suitability check due to regulatory rules.

Leveraged Products

Issued turbo certificates and similar leverage products can be traded once the client completes the necessary knowledge assessment. These products are intended for experienced traders due to their higher risk.

ING’s overall asset coverage is broad enough for most retail investors, with strong emphasis on low-cost wealth building and regulated product access.

Platform & Usability

ING Direct Depot is built around a streamlined user experience that prioritises clarity and reliability. Both the mobile and web platforms deliver simple navigation, intuitive order placement and helpful insights for beginners. While the tools are not designed for professional trading, the overall usability is strong for retail investors focused on long-term portfolio growth, savings plans and occasional stock trading.

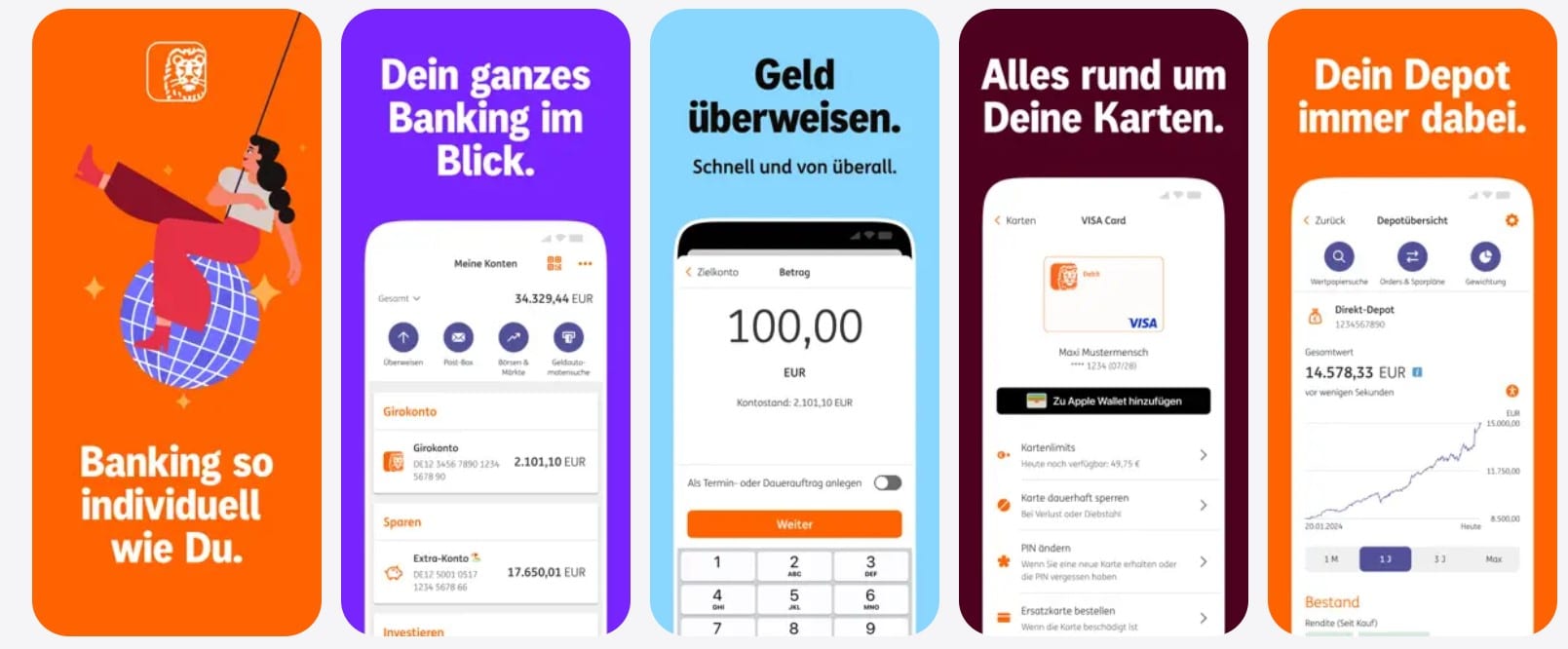

Mobile App

The ING app provides full access to the Direct Depot, including real-time quotes, portfolio overview, watchlists, savings plan setup, dividend reinvestment options and in-app order execution. The interface is clean, stable and optimised for new investors who want quick access to their holdings. Users can search securities, view trends, explore market data and monitor allocations. The app also integrates standard banking functions, which allows seamless transfers to and from the settlement account.

Web Platform

The web interface mirrors the simplicity of the mobile experience. It offers clear navigation through asset classes, order masks, product information and historical price data. Investors can review holdings, manage savings plans, track dividends and access all documentation including cost breakdowns and suitability assessments. The platform is designed for everyday investing rather than high-frequency trading and focuses on transparency, consistency and ease of use.

ING’s platforms emphasise reliability and accessibility over advanced trading features, making them well suited to long-term and beginner investors.

Regulation & Safety

ING Direct Depot is operated by ING-DiBa AG, one of Germany’s largest direct banks. As a fully licensed financial institution, ING is supervised by BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) and the Deutsche Bundesbank, ensuring full compliance with German and EU financial regulations.

Client assets are protected under multiple layers of investor safeguards. Cash balances linked to the settlement account are covered by the German statutory deposit guarantee up to €100,000 per client. Securities held in the depot remain legally separated from the bank’s own assets and are protected in the event of insolvency. Payments, transfers and trading operations run through secure, monitored systems designed to meet strict EU security standards.

As a member of the ING Group, the brokerage benefits from the backing of a large international banking group with a long record of financial stability. Combined with Germany’s strong regulatory framework, ING Direct Depot provides a secure environment for both new and experienced investors.

Who Should Use ING Direct Depot

ING Direct Depot fits investors who prioritise simplicity, transparent pricing and strong long-term investing tools. The platform is ideal for beginners building their first portfolio, since the interface is clean, the order process is straightforward and savings plans start from just €1. Long-term ETF investors benefit the most thanks to €0 ETF savings plan fees, free custody and a wide selection of global index funds.

Occasional stock traders will also find ING suitable, as standard trades are competitively priced for small and medium order sizes. Investors who value a stable, well-regulated institution may prefer ING over newer fintech brokers, since the service is backed by a large German bank with strong security standards.

ING is less suited for active day traders who need advanced charting, derivatives margining or ultra-tight spreads, and it also lacks broad access to global markets beyond Europe and North America. For most everyday investors, however, ING Direct Depot offers a reliable, cost-efficient and user-friendly way to manage a diversified investment portfolio.

FAQ

Frequently Asked Questions

You can trade all securities listed on German exchanges plus selected US and Canadian stocks. ING does not currently offer broad access to Asian or other international markets.

Yes. ETF savings plans execute without a service fee. You only pay the ETF’s internal product costs, which are deducted within the fund itself.

No. Depot custody, settlement accounts and most administrative services are completely free.

Yes. The platform and app are designed to be beginner friendly with simple navigation, clear order screens and helpful educational resources.

Frequent traders may find the percentage-based commission less attractive for large volumes. ING is strongest for long-term investing, savings plans and occasional stock trades.